Navigating Risk. Solving Problems.SM

- Concerned about a lawsuit?

- Received a notice from a regulatory agency?

- Want ways to lower your risk?

Contact Us for a Free Consultation

(757) 434-7656

Expert Risk Mitigation Services:

Addressing Urgent Issues and

Preventing Loss

Have you received a notice from a regulatory agency about safety? Have you gotten legal complaints from customers and employees about your dealership? Do you know if you have enough insurance to cover it when any of these happen? (And they will.) Understanding Risk Mitigation and have a Risk Mitigation Strategy in place are vital to the success of your dealership.

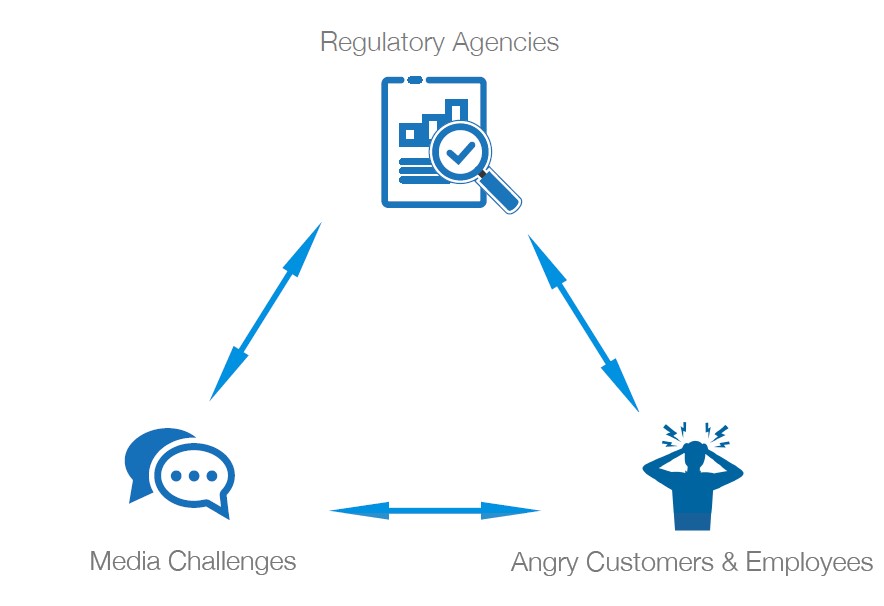

There are so many ways that things can go sideways at a dealership. It’s hard to keep up with all of it and still run your business, keep selling, and achieve your operational goals. Risk comes to you in three forms: regulatory agencies, two-legged problems like customers and employees, and media challenges such as deceptive advertising claims or bad social media reviews. They can distract you from your business, eat up time and cost you plenty if they aren’t handled right.

We have successfully identified and handled thousands of Risk Mitigation issues, saving hundreds

of thousands of dollars in regulatory fines and lawsuits.

Here’s How We Handle the Distraction of Disputes—

and Help You Get Back to Business.

Risk

Risk can be complex and challenging.

Ground Zero: You’ve Gotten Served with a Lawsuit or by a Regulatory Agency

Your dealership is put at urgent risk when you receive an official notice from a regulatory agency or a lawsuit from a disgruntled customer or angry employee.

It can happen a lot of ways:

• A customer slips and falls because a Lot Porter didn’t put out salt where there’s ice

• A customer sues you because there was a paperwork error on the contract

• A customer goes to a regulatory agency because your advertising was deceptive

• An employee is injured in the workplace and claims it was the dealership’s negligence

• An employee believes you discriminated against them because of their age, race, religion, sex or national origin

Although it is best to have a Risk Mitigation Strategy for prevention, now the cat’s already out of the bag.

Initially, there are some smart steps to take:

• Assure that you have enough insurance to cover the problem

• Notify your insurance company that there is a problem

• Discover if you have received a Reservation of Rights letter from your insurance company

• If you have received a Reservation of Rights, it means they may not cover the loss

• You need an experienced risk expert to tell the insurance company why they should cover you

• You need an experienced compliance negotiator in place to meet with the regulatory agency

• You need an experienced dispute resolution expert to bring the lawsuit to a successful outcome

The Key is Prompt and Cost-effective Response with the Goal of Satisfied Parties on All Sides.

Step 1 – Find the Facts: A One-Day or Two-Day Risk Mitigation Audit

Risk Mitigation works best when we find problems, stop them systematically and prevent them from happening again—as much as possible.

Our Risk Mitigation Audit includes:

• Review 5 years of insurance loss runs

• Take inventory of all insurance policies

• Walk the facility, spend time in the Sales and F&I departments

• Review customer demand letters, written complaints and lawsuits

• Review FTC complaints and EEOC complaints for the past 3 years

• Conduct online searches for BBB complaints and reputation responses

• Talk with your on-site Risk Manager

Once We Conduct an Audit, We can Make Targeted Recommendations for Risk Mitigation.

Step 2 – Create A Risk Mitigation Roadmap and Strategy

Based on the dealer and website audits, we create a Risk Mitigation Roadmap to determine and prioritize a plan of action to address challenges, issues, needs and how to proceed in a timely way.

Your dealership’s Rick Mitigation Roadmap will include:

1. Written policies and procedures

2. Designated compliance officer

3. Effective training and education

4. Effective lines of communication

5. Internal monitoring and auditing

6. Enforcement of standards through well-publicized disciplinary guidelines

7. Prompt response to detected problems through corrective actions

Our Risk Mitigation Roadmap is a Time-Tested and Proven Way to Significantly Mitigate Risk.

Step 3 – Stay the Course Until Systemic Risk Mitigation is Achieved

We will stay with you and do what it takes to help you achieve success and reduce significant risk to your dealership through mitigation. We work with you and your lawyer every step of the way until any risk issues are resolved to the best possible outcome.

Smart Lawyers and Clients Love Working With Us.

Step 4 – Provide Support to Prevent Future Risk Mitigation Issues

You’re out of pain and back to business. What policies, personnel and procedures need to be put into place to prevent these same kind of risk issues from happening again? We can support you on a regular basis, coach your employees and do follow-up audits to assure success.