Navigating Risk. Solving Problems.℠

-

Do you have business interruption insurance to offset any losses for having to close any departments?

-

Are you aware you could be reimbursed for sanitizing your dealership?

Contact Us for a Free Consultation

(757) 434-7656

COVID-19 Business Interruption:

Addressing Closures and Mitigating Loss

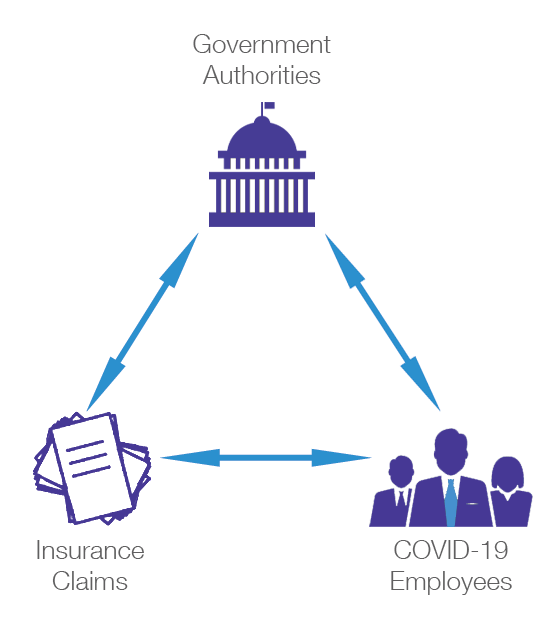

The COVID-19 crisis is upon us. Dealerships and other businesses are facing business interruption by city, county, state and national government authorities.

In addition to the potential closure of departments or your entire dealership, there are other essential issues at stake, such as having employees who test positive for COVID-19. Clean up and sanitization can cost up to $3 per square foot, in addition to the loss of revenue.

Getting a claim handled successfully can turn on a word.

Business interruption claims are complex. They involve examination of multiple policy provisions. Some sections will provide beneficial coverages while other sections will exclude them. Both property and pollution policies, for instance, will use a variety of words which may or may not cover “a virus.” How much you are able to recoup successfully depends not only on your insurance policies but how strategically you use the policy language to present your case.

Here’s How We Handle Business Interruption—

and Help You Get Back to Business.

Step 1 – Understand the Facts of Your Situation

First, we need to collect the facts :

- Has your dealership or business been shut down because you were forced to by government authorities?

- Have employees tested positive for COVID-19?

- Have you shut down because of the positive test(s)?

- Have you incurred or will you incur extraordinary cleaning and sanitizing expenses as a result ?

- What are you facing right now—and what do you want to accomplish?

Step 2 – Review Your Current Insurance Policies

Next, we conduct a thorough and meticulous review of your current insurance policies. We gain a comprehensive understanding of the scope, limitations and exclusions within your policies. This becomes the foundation for creating the strategy we develop to achieve optimal outcomes for your dealership.

Step 3 – Create a Position and Strategy for Success

We create a best case Positioning Statement and Strategy to work around your insurance policies’ limitations and exclusions which is then presented to your insurance companies. This helps us achieve the best possible outcome for your dealership, so we can help you receive the greatest benefits in the fastest time frame.

Step 4 – Craft and Submit Your Claims

We help you craft and submit your claims, illustrating the business case math of the interruption to your best advantage. This focuses on a review of financials—including fixed expenses, variable expenses, and revenue generated by your profit centers. It also includes “What If Scenarios,” such as closing your Sales Department, but not your Service Department… and what those projections look like.

Step 5 – Provide Support for Negotiation and Settlement

We will be there with you, to help you in the final settlement process with your insurance company. Tasks will include:

- Back and forth paperwork

- Pro Formas, i.e.: financial projections of loss of revenue

- Presentations and phone conferences